19+ nd paycheck calculator

Salary Paycheck Calculator North Dakota Paycheck Calculator Use ADPs North Dakota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Just enter the wages tax withholdings and other information required below and our tool will take care of.

Income Calculators Pay Check Salary Wage Time Sheet

Ad Compare 5 Best Payroll Services Find the Best Rates.

. It is not a substitute for the advice of an accountant or other tax professional. North Dakota levies a progressive state income tax with five brackets based on income level. First calculate the number of hours per year Sara works.

Ad Create professional looking paystubs. Be sure to pay your SUI in full and on time so. No North Dakota cities charge local income taxes.

This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off. No personal information is collected. We use the most recent and accurate information.

The Paycheck Calculator may not account for every. North Dakota Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal.

Make Your Payroll Effortless and Focus on What really Matters. How to calculate annual income. This North Dakota hourly paycheck calculator is perfect for those who are paid on.

Net income Payroll tax rate Payroll tax liability Step 6 Minus everything Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every year if there is any and any post-tax deductions. The rate ranges from 008 all the way up to 969 on the first 38400 in wages paid to each employee in a calendar year. 37 x 50 1850 hours.

In a few easy steps you can create your own paystubs and have them sent to your email. Calculate your North Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Dakota paycheck calculator. New construction employers will have to pay 609.

If youre a new employer you will pay 102. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The state is notable for its low income tax rates which range from 110 to 290.

The state income tax rate in North Dakota is progressive and ranges from 11 to 29 while federal income tax rates range from 10 to 37 depending on your income. Next take the total hours worked in a year and. Figure out your filing status work out your adjusted gross income Net income Adjustments Adjusted gross income calculate your taxable income.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Simpson diversity index calculator. Switch to North Dakota hourly calculator.

What is her estimated annual income. Overview of North Dakota Taxes. Calculating your North Dakota state income tax is similar to the steps we listed on our Federal paycheck calculator.

This income tax calculator can help estimate your average income tax rate and your take home pay. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Dakota residents only. Details of the personal income tax.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Area of kite calculator. State Date State North.

Our paycheck calculator is a free on-line service and is available to everyone. This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. The North Dakota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and North Dakota State Income Tax Rates and Thresholds in 2022.

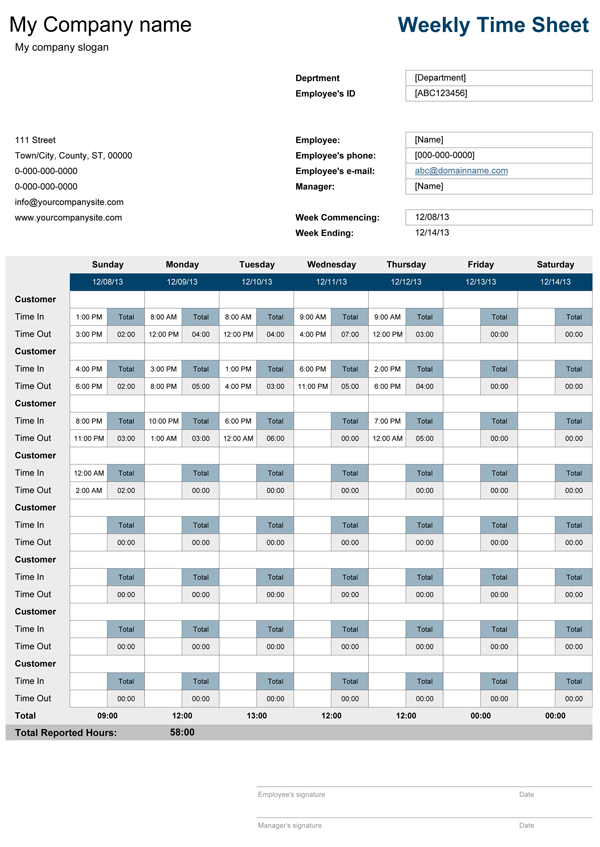

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Paycheck Calculator Take Home Pay Calculator

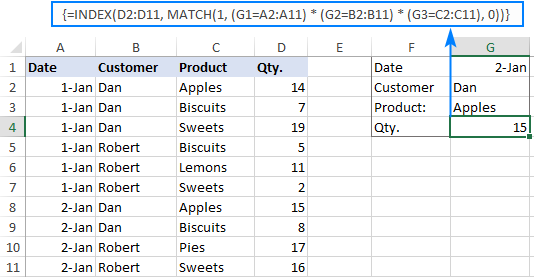

Advanced Vlookup In Excel Multiple Double Nested

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Free Paycheck Calculator Hourly Salary Usa Dremployee

Us Paycheck Calculator Queryaide

62 Free Pay Stub Templates Downloads Word Excel Pdf Doc

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

19 Sample Paycheck Slip Templates In Pdf Ms Word

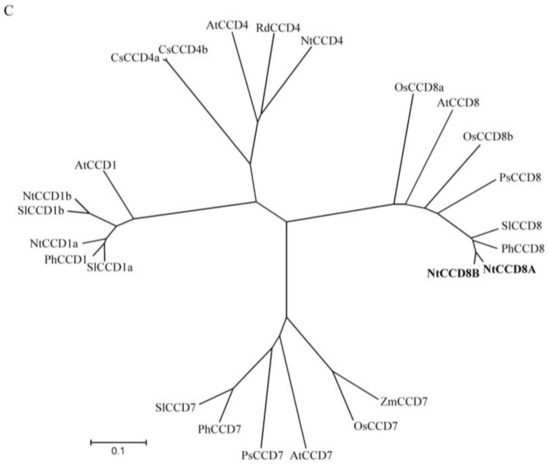

Ijms Free Full Text Crispr Cas9 Mediated Mutagenesis Of Carotenoid Cleavage Dioxygenase 8 Ccd8 In Tobacco Affects Shoot And Root Architecture Html

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Pdf Why Are Households That Report The Lowest Incomes So Well Off

Simple Payroll Tax Calculator Free Paycheck Calculation

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

North Dakota Paycheck Calculator Tax Year 2022

Coronavirus Advice Stallardkane Associates

Komentar

Posting Komentar